2021 EY Global Payroll Survey Global

Once this salary level is set, it must be paid consistently with the appropriate amount of taxes withheld on both the employee (who, in this case, is the owner) and the business side. Be transparent about the different ways employees are compensated at your business, whether it’s hourly pay, salary, bonuses, commission or stock options. In addition, pay careful attention to state laws covering the payment of final wages to those who leave your organisation. Nonexempt employees covered by the Fair Work Act must be paid no less than minimum wage for all hours worked and at least one-and-a-half times their regular pay rate for each hour worked over 38 in a workweek. If your state also has overtime regulations, you must follow the law that provides the most generous benefit to the employee.

How hard is payroll processing?

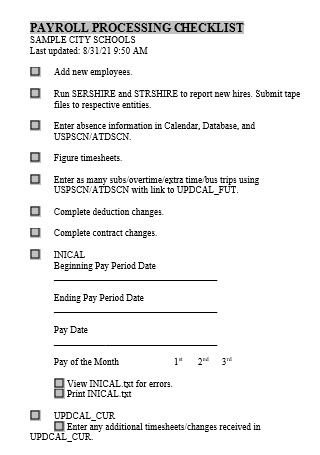

You won’t have a week 53 if your employees are paid monthly, so you can continue processing payroll as usual. To help streamline your Year-End payroll process, we’ve created a checklist to ensure all tasks and deadlines are met. This guide provides clear steps for filing requirements, special adjustments, and system resets. Report and Update Payroll Records After payments are made, it’s essential to update payroll records and review payroll data to generate reports for actionable insights and to track tax contributions.

Payroll for nonprofit organizations: Tax, benefits, and reporting rules

End-to-end payroll processing integrates payroll with other aspects of workforce management, such as performance measurement, training, scheduling, benefits, and compensation. By making this connection, you can improve communication, recordkeeping, analytics, and efficiency throughout the employee life cycle. The Fair Work Act entitles employees to a national minimum wage and outlines specific conditions for overtime pay, penalty rates, and other entitlements.

Tax Withholding

- The deduction components can be categorized as either statutory or non-statutory.

- Simply stated, organizations with formal and documented payroll strategies built a more efficient payroll operation than those without a formal policy.

- Plus, it can help ensure you remain compliant with federal and state tax and labour laws.

It involves gathering essential employee information and validating attendance-time data. The coronavirus has impacted many businesses and may have affected your payroll process, too. Some governments have offered different ways to help small businesses around the globe. Calculate federal income taxes – most often, you will pay federal taxes when you pay Social Insurance taxes. With Paycor, you can simply click submit and let us take care of the rest. We provide full-page pay stubs along with direct mailing services, plus a garnishment processing system to make sure all your paperwork is taken care of.

Salary Accounts

- These include employees properly logging their time, calculating gross pay, factoring in any payroll deductions, and then delivering their net pay through a paper check or direct deposit.

- This process can be simplified by using a payroll service, which in some cases, includes cheque delivery.

- They live in Pennsylvania and contribute 5% to an employer-sponsored retirement account, and pay $300 per month for health insurance.

- The Internal Revenue Service (IRS) specifies that the current tax rate for Social Security is 6.2% for both the employer and the employee, totaling 12.4%.

- You can determine an employee’s gross pay using their pay rate and your scheduled pay periods.

- For a more accurate estimate of net pay, use our free hourly payroll calculator.

They will, however, require a marker to indicate that they are off-payroll to be exempt from other pay/deductions such as Auto Enrolment. By following this checklist, you’ll stay on track and minimize the risk of errors or missed deadlines. Enhance your manufacturing processes with customized solutions designed to optimize efficiency and innovation. Looking for HR and payroll solutions for your restaurant or hospitality business? Paychex Flex® has bundle options that allow you to pick the services that fit your business needs. Payroll tasks can be particularly complex among the many items on small business owners’ to-do lists.

What you’ll learn

Proper payroll management is not only about distributing wages but also about maintaining employee satisfaction and adhering to legal requirements. For a very small business (e.g., 1-5 employees) with manual processes or basic spreadsheet-based calculations, processing payroll might initially take anywhere from a few hours to a full day each pay period. This involves gathering timesheets, manually calculating gross pay, deductions, and taxes, then preparing checks or setting up direct deposits, and finally, recording everything. In the simplest terms, payroll processing is how employers calculate and distribute wages to their employees. It involves calculating wages, making sure deductions are accounted for, withholding taxes, and making sure employees receive their paychecks or direct deposits accurately and on time.

Step 6: File Payroll Taxes

Unfortunately, the process is a lot trickier than simply cutting them a check and sending them home for the weekend. Modern payroll solutions like OpportuneHr Payroll automatically update compliance. This saves a lot of time and effort from HR people because they don’t need to continuously follow the everchanging compliance rules. You may have to pay employment back-taxes to your country’s designated federal revenue agency if you misclassify an employee as a contractor. Additionally, you can classify employees as either exempt or nonexempt.

Designating a payroll manager

Now, more than ever, organizations need the ability to access payroll data efficiently and accurately as teams continue to work remotely or in hybrid work models. According to the survey results, the primary challenge for the Payroll function is evaluating hybrid, flexible, or “new ways of working” policies and their impact on multi-jurisdictional payroll withholding. The past year has demonstrated that when required — and with the right tools and technology — many jobs and roles can successfully work from anywhere. Now, many organizations are considering how to leverage the experience of the pandemic to introduce and maintain greater long-term flexibility for their workforce. A hybrid work model can offer this flexibility by blending in-office and remote work while delivering a seamless employee and customer experience, regardless of physical location.

Given its complex nature, processing payroll alone can cost more than you may save initially. Printed cheques were the tried and true method of compensation for many years, but thanks to technology, there are more efficient and less expensive ways to pay your employees. Employees can choose What Is Payroll A 2021 Guide To Processing Payroll to have you withhold money from their pay to fund superannuation plans and insurance premiums. Sometimes, you must also withhold deductions for court-ordered garnishments, such as child support and alimony.

Automated payroll services and software (like OnPay) can simplify the payroll process, reduce errors, and ensure compliance because manual calculations are kept to a minimum (if at all). To help you choose the right solution, check out our guide to some of the best payroll for small businesses available today. This type of software can automatically handle calculations, tax filings, and even direct deposits once employee information is set up. Many providers will onboard businesses to make sure all employee information is inputted correctly. This type of payroll processing is time-consuming and prone to errors, so more and more businesses are turning to automated payroll software solutions.